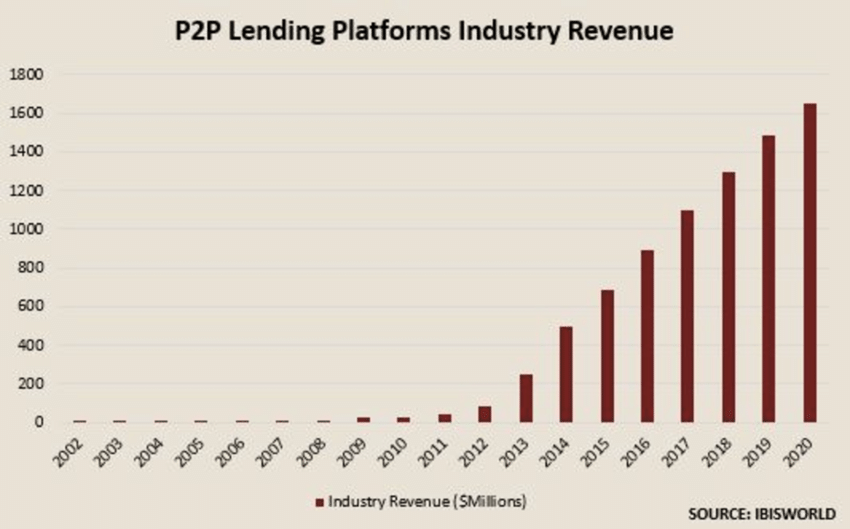

P2P (peer-to-peer) lending has experienced significant growth in recent years, transforming the traditional lending landscape. With the rise of technology, Artificial Intelligence has emerged as a powerful tool in the financial industry, revolutionizing various aspects of P2P lending. In this article, we will explore the diverse ways AI is reshaping the P2P lending sector, enhancing efficiency, reducing risks, and providing borrowers and lenders with unprecedented opportunities for growth and financial success.

The Power of AI in Risk Assessment and Credit Scoring

One of the fundamental challenges in P2P lending is assessing the creditworthiness of borrowers. Traditional methods often rely on historical data and credit scores, but AI brings a new level of sophistication to the process. By leveraging machine learning algorithms and vast amounts of data, AI platforms can analyze borrower profiles, financial records, and alternative data sources to generate more accurate risk assessments.

AI-driven credit scoring models can take into account a multitude of factors, including income stability, employment history, social media activity, and even psychometric data. This holistic approach allows lenders to make more informed decisions, reducing the risk of defaults and ensuring a healthier loan portfolio. With AI, lenders can offer competitive interest rates to borrowers who may have been overlooked by traditional financial institutions, fostering financial inclusion and opportunity.

Image Source: Researchget

Streamlining Loan Origination and Underwriting Processes

The loan origination and underwriting processes are often time-consuming and complex, involving extensive paperwork and manual assessments. However, AI technologies can streamline these processes, making them faster, more efficient, and less prone to errors.

By automating document verification, AI systems can quickly analyze and validate borrower information, minimizing the need for manual intervention. Furthermore, AI algorithms can evaluate loan applications based on predefined criteria, instantly identifying potential red flags or discrepancies. This automation accelerates the decision-making process and ensures a seamless experience for both borrowers and lenders.

➨ READ MORE: METAVERSE TREND IN 2023

Enhancing Customer Experience with AI-Powered Chatbots

In the digital age, providing excellent customer service is paramount to success. AI-powered chatbots have emerged as invaluable assets in the P2P lending industry, delivering personalized and instant support to borrowers and investors alike.

Chatbots equipped with natural language processing capabilities can understand customer inquiries and provide relevant information promptly. They can assist with loan applications, answer frequently asked questions, and guide users through the lending process. By utilizing AI chatbots, P2P lending platforms can offer round-the-clock support, improving customer satisfaction and engagement.

AI-Enabled Fraud Detection and Prevention

Fraudulent activities pose a significant threat to the integrity of P2P lending platforms. To combat this, AI technologies are deployed to detect and prevent fraudulent behavior, safeguarding the interests of both lenders and borrowers.

Through the analysis of historical transaction data, AI algorithms can identify patterns and anomalies associated with fraudulent activities. Real-time monitoring systems can flag suspicious behavior, enabling swift action to mitigate potential risks. By leveraging machine learning and data analytics, P2P lending platforms can stay one step ahead of fraudsters, ensuring a secure and trustworthy environment for all participants.

AI-Based Portfolio Management and Investment Strategies

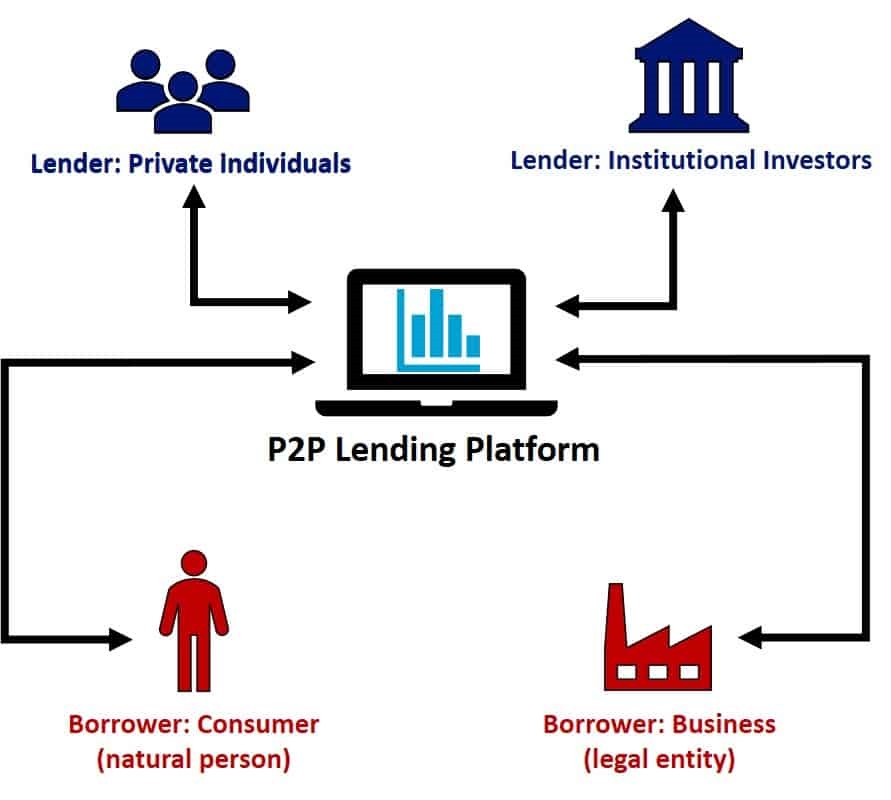

Image source: P2PMARKETINGDATA

For lenders and investors, managing a diverse portfolio and maximizing returns is crucial. AI plays a pivotal role in optimizing portfolio management and devising effective investment strategies.

AI algorithms can analyze vast amounts of financial data, market trends, and borrower profiles to identify optimal investment opportunities. By considering various risk factors and performance indicators, AI-powered portfolio management systems can suggest the most suitable loan projects for investors. These systems can also provide real-time monitoring, enabling proactive adjustments to investment strategies based on market conditions.

Conclusion

The integration of AI into P2P lending has unleashed a wave of transformation, revolutionizing the industry in numerous ways. From advanced risk assessment and streamlined processes to enhanced customer experiences and fraud prevention, AI technologies have become indispensable tools for both borrowers and lenders.

As P2P lending continues to grow, embracing AI-driven solutions will be essential for businesses aiming to stay competitive and provide superior services. By leveraging the power of AI, P2P lending platforms can unlock new opportunities, foster financial inclusivity, and create a thriving ecosystem that benefits all stakeholders.

To keep pace with the ever-evolving landscape of finance, it is crucial for industry players to adopt and embrace the potential of AI. By doing so, they can position themselves at the forefront of innovation, leaving other websites behind and achieving remarkable success in the era of AI-powered P2P lending.

If you want to learn more about how AI can help your P2P lending business grow and thrive, Contact us today. Contact us now and let’s get started!